In the wake of continued disruptions in the Red Sea region, Indian exporters face heightened shipping costs as freight companies opt for longer routes to bypass the Suez Canal, leading to extended voyages and increased freight charges ranging from 80-100%.

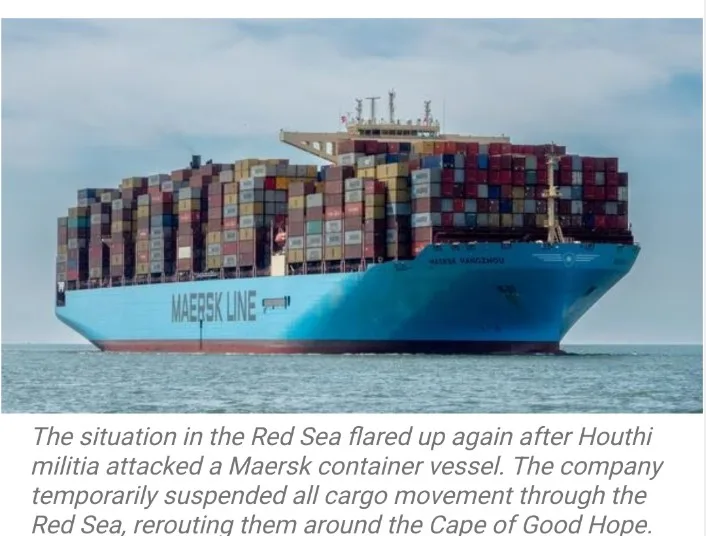

The recent attack by Houthi militia on a Maersk container vessel triggered the suspension of cargo movement through the Red Sea. Companies are now rerouting shipments around the Cape of Good Hope, adding 12-15 days to the voyage.

Shipping major MSC has announced a contingency surcharge of $1,500 per container, and CMA CGM introduced a Red Sea surcharge of $1,575 for 20-foot dry containers and up to $3,000 for reefer containers and special equipment. Other major shipping lines have followed suit with similar surcharges.

Khalid Khan, board member of the Federation of Indian Export Organisations (FIEO), highlighted that these charges come at a time when the involvement of countries like the USA and Iran in the Red Sea is increasing. The situation is anticipated to escalate further, prompting freight companies to exploit the circumstances and impose additional charges.

Maersk, in response to the incident on December 30 involving the vessel Maersk Hangzhou, declared a pause on all transits through the Red Sea/Gulf of Aden until further notice. Vessels will be rerouted around the Cape of Good Hope, contributing to the anticipated price hikes.

Nilesh Thadani, Director of Alltrans Shipping and Logistics LLP, predicts prices to stabilize at around 50-60% higher rates post-de-escalation in the Red Sea. The disruptions in this crucial maritime route to the Suez Canal are a cause for concern, raising questions about the stability of global shipping routes.