In a potential blow to India’s economy, threats to cargo vessels in the Red Sea may result in a significant dent of approximately $30 billion in the country’s total exports for the current fiscal year. The Research and Information System for Developing Countries, a New Delhi-based think tank, conducted an initial assessment, indicating a 6.7% decline in Indian exports based on the previous fiscal year’s total of $451 billion.

Sachin Chaturvedi, the director-general of the think tank, expressed concern, stating, “The crisis in the Red Sea would indeed impact India’s trade and may lead to further contraction.”

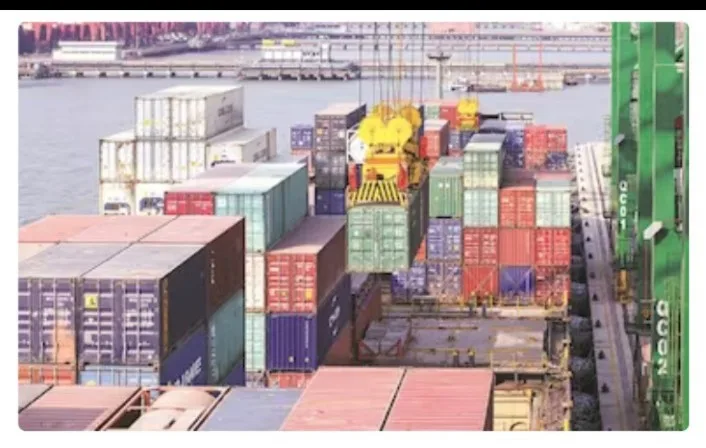

The Suez Canal is experiencing a decline in the number of ships passing through, down about 44% compared to the average for the first half of December. Yemen’s Iran-backed Houthi militants targeting vessels transiting through the Red Sea has led to increased tensions. For India, the Red Sea is a crucial route for shipping to Europe, the US East Coast, the Middle East, and African countries.

Prime Minister Narendra Modi’s government is reportedly in discussions with export promotion councils to explore ways to protect trade transiting through the Red Sea. Recent developments have prompted Indian exporters to withhold around 25% of outbound shipments transiting through the Red Sea. Freight charges are surging, leading to renegotiations of contracts between buyers and exporters.

While the government has not released official estimates on the impact of the Red Sea crisis, concerns are rising about the potential hit to India’s oil and auto sectors. Madhavi Arora, a lead economist with Emkay Global Financial Services Ltd, emphasized the risk of inflation due to higher global freight and insurance rates, potential supply chain disruptions, and increased oil and global trade costs.