New York: In a stark contradiction to its professed commitment to transitioning to a low-carbon economy, the World Bank reportedly channeled billions of dollars into fossil fuel projects worldwide in the past year. These revelations have surfaced in connection with a specific form of funding termed “trade finance,” designed to facilitate global transactions.

Urgewald, a prominent campaign group tracking global fossil fuel finance, has uncovered that the World Bank extended approximately $3.7 billion (£2.95 billion) in trade finance during 2022, with high likelihood that these funds ultimately supported oil and gas ventures.

Heike Mainhardt, the author of this research, has issued a call for comprehensive reform within the World Bank and its private financial arm, the International Finance Corporation (IFC). The primary objective of this reform would be to enhance transparency in such transactions and, critically, to exclude funding for fossil fuels from the bank’s lending practices.

Mainhardt argues that the lack of transparency allows fossil fuel companies to take advantage of public funds discreetly, undermining the bank’s alignment with the Paris Agreement. She asserts that these companies recognize the opportunity to access public resources without drawing attention to themselves.

Trade finance differs from conventional project finance in that it operates in a more opaque manner. While project finance is typically directed toward governments, organizations, or consortiums for clearly defined purposes and is readily traceable, trade finance is more complex and diffuse.

It encompasses a wide array of intricate financial instruments utilized by banks and other financial institutions to provide working capital to governments or businesses. Trade finance may manifest as credit or guarantees and serves as a crucial tool for the World Bank in “de-risking” financing for developing countries, which often face elevated interest rates in the private financing realm.

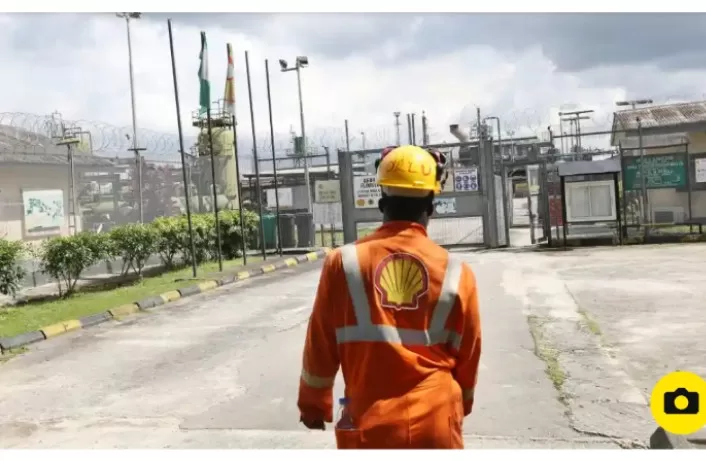

For instance, if an oil developer in Nigeria sought to import drilling or refining equipment, trade finance could offer assurance to the equipment manufacturer regarding payment for the goods. Unfortunately, there is no means of ascertaining whether such transactions occur, as the IFC does not disclose such specifics.

Mainhardt scrutinized trade finance transactions conducted by the IFC and applied estimates based on financing allocations to oil and gas ventures between 2006 and 2012—the last period for which reliable estimates are accessible. Given the IFC’s continued extensive dealings with oil-producing nations, especially in the Middle East and Africa, it is improbable that the overall allocation to fossil fuels has undergone substantial change. Furthermore, the IFC’s trade finance transactions are not exclusive to oil, gas, and coal.

Many nations, both developed and developing, are presently advocating for the overhaul of the World Bank, contending that it must shift its focus toward fostering a low-carbon global economy. The bank witnessed the appointment of its new president, Ajay Banga, in June, succeeding the former president, Trump appointee David Malpass, who faced questions regarding his stance on climate change.

Mainhardt asserts that reform should encompass enhanced transparency in trade finance and the exclusion of oil, gas, and coal from the bank’s financing for such transactions. She underscores the critical importance of these changes.

In response to these revelations, an IFC spokesperson issued a statement disputing the accuracy of Urgewald’s report, asserting that it grossly overstates the IFC’s support for fossil fuels. The spokesperson maintained that IFC’s trade finance projects undergo a rigorous selection process that balances climate commitments with the development needs of the countries they engage with. The IFC does not support coal in trade financing, and oil and gas projects are considered on a limited basis, exclusively for distribution (not production) purposes contingent upon development impact.

The spokesperson also emphasized that the IFC routinely provides accurate and timely project information through various channels.