On Thursday, it came to light that Elon Musk is facing an investigation by the US Securities and Exchange Commission (SEC) regarding his $44 billion acquisition of Twitter, the social media giant he subsequently rebranded as X.

This investigation is centered on whether Musk violated federal securities laws during 2022 when he purchased stock in Twitter and made statements and SEC filings related to the transaction.

In March 2022, Musk acquired a substantial 9.2% stake in Twitter, effectively making him the company’s majority shareholder. However, this purchase was not disclosed in an SEC filing until the following month. Subsequently, Twitter shareholders initiated a lawsuit, alleging that the delayed filing violated securities regulations. Nevertheless, the suit was later dismissed. Faced with an impending trial aimed at compelling him to complete the deal, Musk proceeded to acquire the remaining Twitter stock for $44 billion in October 2022, effectively taking control of the company.

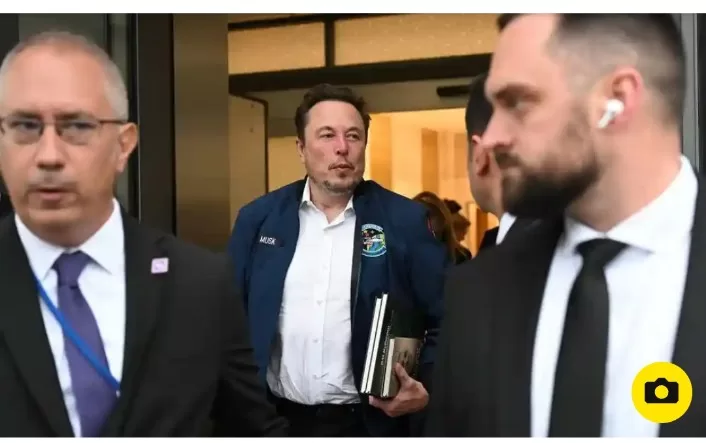

The SEC’s inquiry became public knowledge when the agency filed a lawsuit to compel Musk to provide testimony in their ongoing investigation, to which he had initially agreed but later withdrew his commitment.

The SEC disclosed that they had subpoenaed Musk in May 2023, mandating his testimony at the agency’s San Francisco office. Musk had initially agreed to appear, but just two days before his scheduled testimony, he raised several objections and informed the SEC of his decision not to participate. Musk also rejected the SEC’s proposals to conduct the deposition in Texas, his legal residence, in either October or November.

Among Musk’s objections was his assertion that the SEC was attempting to “harass” him, and he claimed that his legal counsel required additional time to review potentially pertinent information contained in a biography of Musk published the previous month.

In response to these developments, Alex Spiro, an attorney representing Musk, stated, “The SEC has already taken Mr. Musk’s testimony multiple times in this misguided investigation—enough is enough.”

This legal conflict is a continuation of a longstanding feud between Musk and the SEC, which dates back to Musk’s 2018 tweet in which he claimed to have secured funding to take Tesla private. The SEC imposed a $20 million fine on Musk for misleading investors and compelled him to relinquish his role as chairman of Tesla. Despite the penalty, Musk has subsequently disparaged the SEC on numerous occasions, and the regulatory body has initiated multiple investigations into Musk’s activities over the years.

Thursday’s legal action serves to escalate this ongoing battle between Musk and the SEC, casting further uncertainty over the outcome of the investigation.