In a noteworthy display of commitment to shore up the Chinese economy, President Xi Jinping has taken several unprecedented steps, including raising the budget deficit ratio and embarking on an extraordinary visit to the central bank. These actions reflect China’s dedication to addressing the challenges and uncertainties that lie ahead for the world’s second-largest economy.

The Chinese legislature recently approved a plan to elevate the fiscal deficit ratio for the year 2023 to approximately 3.8% of the gross domestic product (GDP), as reported by the official Xinhua News Agency. This significant increase surpasses the 3% benchmark set in March, which had been historically regarded as a cap on the nation’s fiscal deficit. Part of this plan involves the issuance of an additional 1 trillion yuan (equivalent to $137 billion) in sovereign debt during the fourth quarter. The funds are intended to bolster disaster relief efforts and construction projects.

It is a rare occurrence for China to make mid-year budget adjustments. Previous instances of such modifications transpired in 2008, following the Sichuan earthquake, and during the late 1990s in response to the Asian financial crisis.

Mark Williams, Chief Asia Economist at Capital Economics Ltd, commented on these developments, stating, “The additional fiscal support approved today is the intervention we had been expecting and that was needed to prevent an abrupt fiscal tightening in China in the closing weeks of the year.”

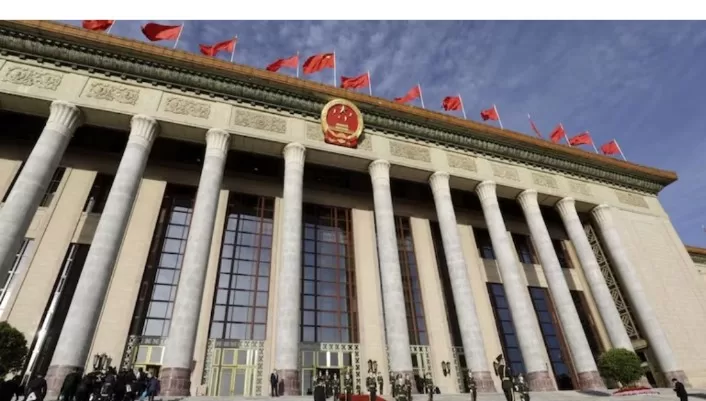

These fiscal changes were announced during a series of announcements from the Standing Committee of the National People’s Congress, the legislative body under the control of the Communist Party overseeing government borrowing.

In addition to the fiscal adjustments, other significant reshuffles took place during this period. Li Shangfu, who had disappeared from public view two months ago, was ousted as defense minister. Furthermore, former foreign minister Qin Gang had his remaining role as State Councilor stripped. As part of these high-profile reshufflings, Lan Fo’an was appointed as the new finance minister, replacing Liu Kun, a move that had been widely anticipated.

These budget revisions underscore the top leadership’s concerns about China’s economic outlook for the upcoming year. There is a renewed focus on shoring up the economy and financial markets. In a surprising turn of events, President Xi Jinping made his first known visit to the central bank, marking a significant moment in his decade-long tenure as the Chinese president.

This move aligns with reports from Bloomberg earlier this month, suggesting that Chinese policymakers were considering elevating the current year’s budget deficit and issuing additional sovereign debt. These measures are part of a concerted effort to achieve China’s official government growth target of approximately 5% for the year 2023. Stronger-than-expected data for the third quarter has instilled “very confident” sentiments among authorities regarding the nation’s ability to meet this growth target. Nevertheless, challenges, including ongoing property market instability and deflationary pressures, are anticipated to persist into 2024, with economic growth projected to slow to 4.5% next year.

The issuance of 1 trillion yuan in special bonds for post-disaster reconstruction equates to additional fiscal stimulus, contributing about 0.8% of GDP, as noted by Duncan Wrigley, Chief China Economist at Pantheon Macroeconomics Ltd. This infusion aims to support China’s recovery as it approaches 2024, combating headwinds caused by declining property construction and exports.

Furthermore, the decision to finance infrastructure investment through sovereign bond issuance signals a shift in policy thinking, placing a greater fiscal burden on the central government rather than local authorities, who have limited room for leverage. These additional funds will be transferred to local authorities for use in projects during this year and the next, as per the announcement made on Tuesday.

In addition, legislators extended an authorization for the State Council to front-load some of next year’s local bond quota through 2027. Zhao Leji, Chairman of the Standing Committee, urged for an acceleration in the issuance of new local government notes and the prudent utilization of the raised funds.

Beijing has displayed a growing commitment to assisting local governments facing fiscal challenges. Last month, it initiated a program to allow struggling regional authorities to exchange high-interest off-balance-sheet borrowing for lower-interest bonds.

In a report submitted to the Standing Committee over the weekend, People’s Bank of China Governor Pan Gongsheng vowed to make policies “more” targeted and potent. Pan emphasized a longer-term perspective on the economy and indicated that there is room for easing, underscoring the counter-cyclical and cross-cyclical adjustments that policy will facilitate.

This comprehensive approach underscores China’s resolute dedication to achieving economic stability and growth, even in the face of persistent challenges. President Xi Jinping’s unprecedented actions reflect a determination to steer the nation through these uncertain times.

By Bloomberg