Beijing- In a striking revelation, China has emerged as the world’s foremost debt collector, with an astounding debt portfolio of over a trillion dollars tied to its ambitious Belt and Road Initiative (BRI), according to a recent report. A staggering 80 percent of these loans are allocated to nations grappling with financial hardships.

The Belt and Road Initiative, unveiled by President Xi Jinping a decade ago, has garnered participation from more than 150 countries, extending from Uruguay to Sri Lanka. Over the past decade, China has disbursed colossal loans to facilitate the construction of critical infrastructure, including bridges, ports, and highways, in both low and middle-income nations.

However, the initial wave of lending is now transitioning into the principal repayment phase, with projections indicating that three-quarters of these loans will reach that stage by the end of this decade. These findings were disclosed in a report published by AidData, a research institute affiliated with Virginia’s College of William and Mary, which specializes in tracking development finance.

AidData’s comprehensive analysis, encompassing data from nearly 21,000 projects spanning 165 countries, has spotlighted China’s commitment to provide financial support to low and middle-income nations, currently hovering at an annual rate of approximately $80 billion. By contrast, the United States contributes $60 billion annually to similar countries.

The report encapsulates China’s evolving role on the global stage as it assumes the mantle of the largest official debt collector. AidData estimates that the total outstanding debt, comprising principal amounts but excluding interest, owed by developing nations to China, surpasses the astonishing mark of $1.1 trillion. Remarkably, 80 percent of China’s overseas lending portfolio is channeled toward nations confronting financial distress.

Supporters of the Belt and Road Initiative hail its role in ushering resources and economic prosperity into the Global South. Nevertheless, critics have consistently raised concerns about the opacity of project pricing, with countries like Malaysia and Myanmar renegotiating agreements to curtail costs. Additionally, China’s approval rating among developing countries has waned, plummeting from 56 percent in 2019 to a mere 40 percent in 2021.

In response to these challenges, China is embarking on a journey of learning from past mistakes and transforming into a more adept crisis manager. The report emphasizes Beijing’s efforts to reduce risk in the Belt and Road Initiative by aligning its lending practices with international standards. Among these efforts are the implementation of increasingly stringent safeguards to shield against the risk of non-repayment.

One such measure involves permitting key Belt and Road Initiative lenders to unilaterally access principal and interest payments by seizing borrowers’ foreign currency reserves held in escrow. These cash seizures often transpire clandestinely, beyond the immediate purview of domestic oversight institutions, especially in low- and middle-income nations. This ability to access cash collateral without borrower consent has become a pivotal safeguard in China’s bilateral lending portfolio.

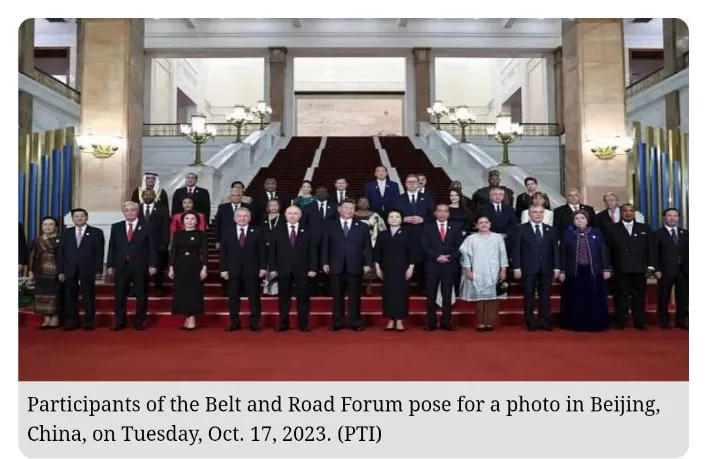

During a recent landmark summit in Beijing commemorating the tenth anniversary of the Belt and Road Project, President Xi Jinping pledged to inject more than $100 billion in fresh funds into the initiative. However, a joint report issued earlier this year by the World Bank and other institutions, including AidData, revealed that Beijing had been compelled to extend billions of dollars in bailout loans to BRI participant countries.

Furthermore, the Belt and Road Initiative has faced scrutiny over its substantial carbon footprint and the environmental consequences stemming from its massive infrastructure undertakings.

By AFP