Trailer axle and suspension assembly manufacturing company, Kross, has taken a significant step towards an initial public offering (IPO) by filing draft papers with the capital markets regulator to raise Rs 500 crore.

The IPO plan includes a fresh issuance of shares worth Rs 250 crore by the company and an offer-for-sale (OFS) of shares worth Rs 250 crore by promoters Sudhir Rai and Anita Rai. In the OFS, Sudhir Rai and Anita Rai will be selling shares worth Rs 168 crore and Rs 82 crore, respectively.

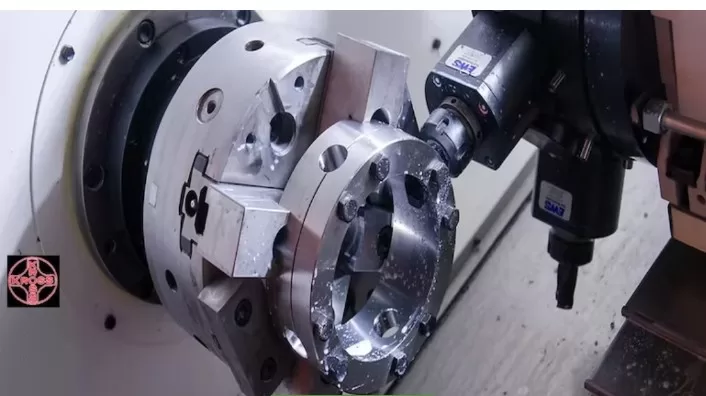

The Jharkhand-based forged and machined components maker is also contemplating a pre-IPO placement to raise Rs 50 crore. If this pre-IPO placement materializes, the fresh issue size will be adjusted accordingly.

The net proceeds from the fresh issue are intended for the purchase of machinery and equipment (Rs 70 crore), working capital requirements (Rs 30 crore), and debt repayment (Rs 90 crore). Any remaining funds will be earmarked for general corporate purposes.

Kross, a company promoted by the Rai family, caters to the Medium and Heavy Commercial Vehicles (M&HCV) and farm equipment segments. It has demonstrated robust financial performance, reporting a year-on-year profit surge of 154.2 percent to Rs 30.93 crore for the fiscal year ending March FY23. During the same period, revenue from operations grew by 64.3 percent to Rs 488.6 crore, and EBITDA increased by 95 percent to Rs 57.5 crore.

In the first quarter of the current fiscal year (FY24), Kross recorded a profit of Rs 8 crore on revenue of Rs 143.7 crore.

Kross boasts enduring relationships with leading Original Equipment Manufacturers (OEMs) such as Ashok Leyland and Tata International DLT.

Equirus Capital has been appointed as the merchant banker for the IPO.