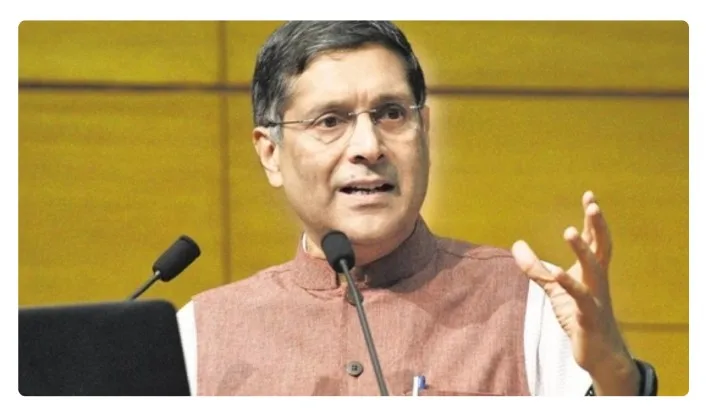

Renowned economist Arvind Subramanian, former Chief Economic Adviser during 2014-2018, expressed concerns about India’s regulatory framework in a recent Washington Post article titled ‘India Is Chasing China’s Economy. But Something Is Holding It Back.’ Subramanian suggested that navigating India’s regulatory landscape could be challenging for businesses not affiliated with Adani or Ambani, highlighting what he called the “Modi phenomenon.”

“If you’re not the two A’s — Adani or Ambani — it can be treacherous to navigate India’s regulatory byways. Domestic investors feel a little bit vulnerable,” Subramanian shared in the interview.

He pointed out the “Modi phenomenon,” characterized by hype, bluster, and manipulation, although acknowledging a core of achievement. The economist hinted at an environment favoring mega conglomerates and raised concerns about the vulnerability felt by domestic investors.

Addressing concerns about India’s economic growth, Subramanian acknowledged achievements but emphasized the need for reassurance among investors. The article underscored issues like red-tapism and questioned the evidence of investor confidence in the current regulatory landscape.

India’s GDP grew by 7.2 percent in the fiscal year 2022-2023, and Subramanian urged keeping an open mind for future possibilities. The Washington Post’s analysis suggested a hitch in India’s growth story, emphasizing the importance of sustained growth to meet national goals by 2047.

Mukesh Ambani and Gautam Adani, leading Indian business figures, were highlighted in the context of their conglomerates’ diverse interests. The Opposition’s claims of bias toward the Adani Group were noted, along with the conglomerate’s resilience in the stock market after previous challenges.