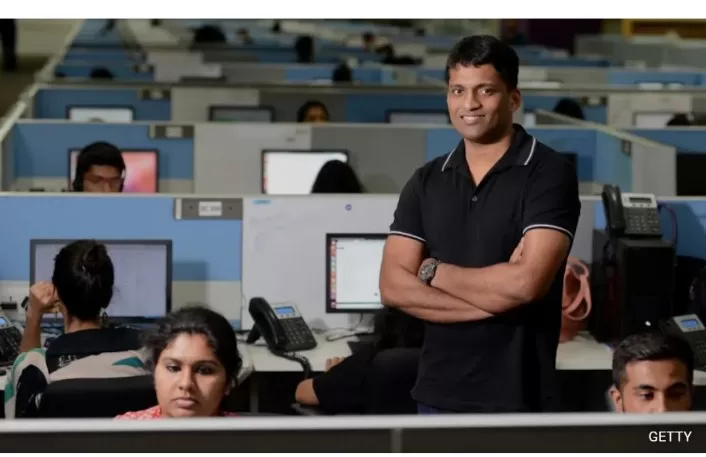

New Delhi, In a significant blow to Byju’s, the edtech startup’s valuation has plummeted to under $3 billion, marking an alarming 86% decline from its peak valuation of $22 billion just a year ago. This drastic fall comes amid a tumultuous period for Byju’s, characterized by cash-flow problems and an ongoing dispute with creditors over a substantial $1.2 billion loan.

Byju’s, once hailed as the poster child for India’s flourishing startup economy, has been grappling with financial challenges as it struggles to recover from the impact of the post-Covid era. The company’s valuation has witnessed successive cuts over the past year, with shareholders, including Prosus and Blackrock, adjusting it to $11 billion in March, $8 billion in May, and $5 billion in June.

The latest revelation regarding the diminished valuation was disclosed by interim CEO Ervin Tu during the Prosus earnings call. This disclosure comes on the heels of Byju’s announcement of a staggering ₹2,250 crore loss. The edtech giant had also delayed filing its financial results for the fiscal year 2021/22 by almost a year, leading to resignations from key positions, including the departure of auditor Deloitte and three board members. Last week, both the chief financial officer and chief technology officer resigned.

The financial results underscore the challenges Byju’s is facing in its attempt to revive from the post-pandemic slump. The company, known for its aggressive expansion during the pandemic, invested heavily in acquiring several edtech startups, not only in India but also in the United States.

However, the growth momentum has slowed with the resumption of regular classes, and Byju’s is now confronted with a prolonged legal dispute that shows signs of escalating. Creditors took legal action against Byju’s after it breached covenants on the $1.2 billion loan, bringing founder Byju Raveendran into the spotlight.

Prosus did not provide a specific reason for the valuation cut in its recent disclosure. However, in July, the tech investor stated that Byju’s management “regularly disregarded advice,” despite repeated efforts to improve governance.

The challenges for Byju’s extend beyond its financial troubles. The company, once the official sponsor of the Indian cricket team, is now facing a case filed by the Board of Control for Cricket in India (BCCI) over a missed payment of sponsorship royalties, amounting to approximately $20 million.

Byju’s rapid fall from a $22 billion valuation to under $3 billion within a year underscores the uncertainties and hurdles faced by even the most prominent players in India’s startup landscape.