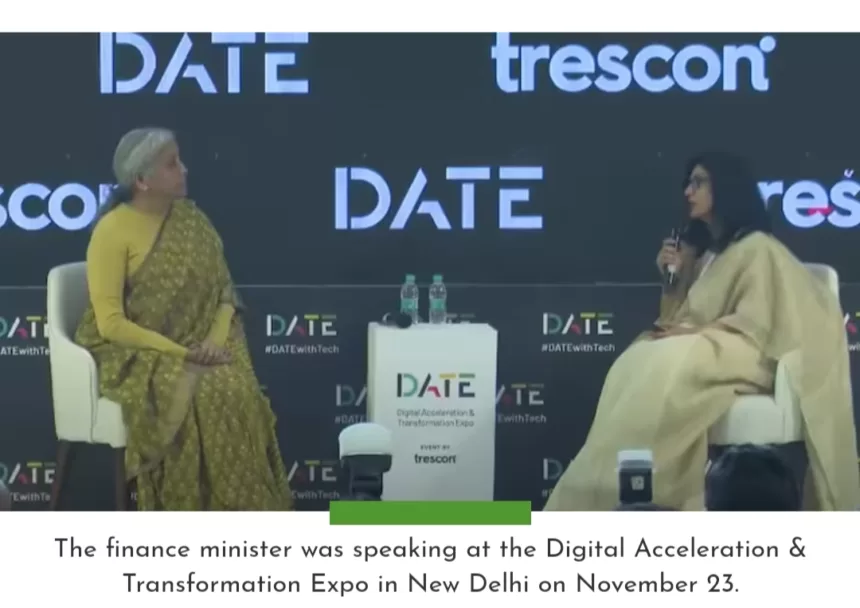

New Delhi — Finance Minister Nirmala Sitharaman expressed her perspective on the Reserve Bank of India’s (RBI) recent actions to curb the rapid expansion of certain segments of retail loans. Speaking at the Digital Acceleration & Transformation Expo in New Delhi on November 23, she conveyed that the RBI is conscientious about identifying the “thin line” and is taking preventive measures to avoid exuberance in credit growth.

“The RBI is conscious of where the thin line actually lies. They are red-lighting it now so that NBFCs (non-bank finance companies) or small finance companies don’t go too far in their enthusiasm,” stated Sitharaman.

Acknowledging the positive aspect of enthusiasm, Sitharaman emphasized the need for caution, stating, “Enthusiasm is good, but sometimes it becomes a bit too far for people to digest. So as a measure of caution, RBI has also alerted banks, small finance banks, NBFCs to be careful that they don’t go too far too soon and face any downside risks later.”

These remarks follow the RBI’s recent measures aimed at moderating the growth observed in specific consumer credit categories. Governor Shaktikanta Das, on November 22, advised financial institutions to exercise caution and ensure that credit growth, across all levels, remains sustainable, urging the avoidance of “all forms of exuberance.”

In addition to discussing the RBI’s approach, Sitharaman communicated her directive to public sector banks, urging them to concentrate on core banking activities, including deposit collection, lending, and profit generation through lending. She also stressed the importance of providing reasonable returns to individuals who entrust their savings to these banks.

Sitharaman’s comments come against the backdrop of concerns raised by the RBI about the pace of growth in certain retail loan segments, signaling a proactive approach to maintain stability in the financial sector.